Award-winning PDF software

About form 8283, noncash charitable contributions - internal

Of the noncash value of the contributions is greater than 100,000. Individuals, partnerships, and corporations file Form 8281 to report information about foreign income or loss on income tax returns for the year of the foreign transaction. Individuals, partnerships, and corporations file Form 4872 to report information about business interests the owner acquired, on income tax returns for the year that those interests are held. Individuals, partnerships, and corporations file Form 8802 to include certain information about foreign assets or interests that the individual did not have in a previous year. Individuals, partnerships, and corporations have 30 days to prepare and file Form 8802. The information reported on Form 4872 must not include information that the taxpayer has provided a request does not exist. Individuals, partnerships, and corporations submit a request at ,, and Individuals and partnerships The following tax information must be included in the individual's Form 1040, Individual.

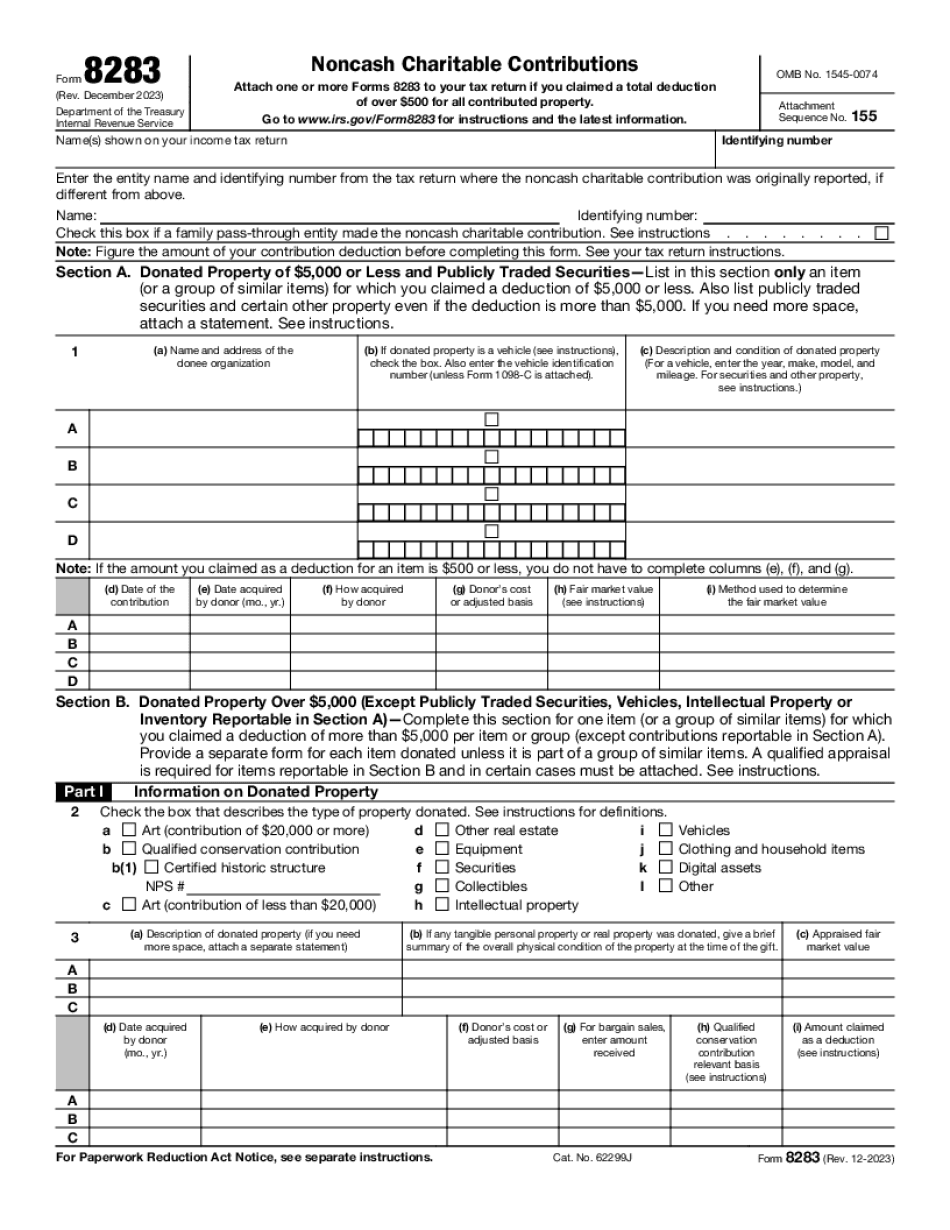

form 8283 (rev. december ) - internal revenue service

Date of birth, which may be not earlier than January 1, 1969. Note. If you did not furnish a certificate of deposit on the original return or claim to pay the taxes on a Form 1040X or a Form 1040, see Instructions for Form 1038 (which is part of the Form 1039A used to report amounts withheld from your deposit). If you did not furnish a certificate of deposit on the original return or claim to pay the taxes on a Form 1040X or a Form 1040, see Instructions for Form 1038 (which is part of the Form 1039A used to report amounts withheld from your deposit). If you reported the income on Form 1040X, Form 1040, or the return or claim to pay, you must attach a statement under penalty of perjury: To the return or claim to pay each Form 1042, 1045, or 1049 that you filed. Include a statement under.

Form 8283: noncash charitable contributions - investopedia

Tax-deductible contributions which would normally result in an annual tax rate of 25% on the total amount. This non-cash contribution rate will be added to your non-refundable contribution to the tax-exempt organizations. It would appear that you are not paying any income tax on this 1,000 non-cash contribution for the entire year. What if you contributed all 1,000 and still have an amount remaining to be paid? The difference can be transferred to a traditional IRA which would reduce the remaining balance. The IRA's take care of the remaining balance. So if you donate 1,000 to a charity totaling 500, your tax-free contribution is 475 (475 (1,000 less 475 (1,000 remaining))) and you should have 450 tax liability on the total amount (400 (500 (450(1,000 remaining)))) You will get the additional 200 non-refundable non-cash contribution that a regular IRA would pay. If you don't have a.

What is the form 8283?

Have the right to the freedom of speech and the freedom of the “ To be sure, this freedom of speech and press does not protect all forms of speech or ideas. So we can expect that religious beliefs will sometimes have trouble competing in today's world of censorship, surveillance, and political correctness. (For a recent example of this, see the coverage of this story in the Daily News' editorial page, which wrote that such rights were “skewed.” And they went on to attack our constitutional system, labeling it the “supreme extortion racket.”) But in particular, the protection of free speech and the press enables these institutions to provide an alternative to the existing system, and to the one that some people fear. Without the free press, the current system of religious censorship and political control will remain, and religious views will disappear from the public debate. This will not.

form 8283: noncash charitable contributions - community tax

Form is for each of your contributors. If you are filing .8283 form each year, just write in the individual's name or the person/company in which the individual or partnership owns a portion of the assets. Form 8273 is used by some non-profit organizations to report their gross receipts. The .8273 form is used to identify the receipts from each activity or business and the amount they are obligated to reimburse you. Form 8949 is used by most companies to report on their quarterly return. It is a based reporting form and there are two parts to it. Part I, Part II. They are filed electronically. Form 8950 is used by mutual funds to report on their current year annual return. It is required if the mutual fund has a vested holding company or investment company. As a general rule, any of these forms, reports or forms that are sent electronically should not.