Award-winning PDF software

Cambridge Massachusetts online Form 8283: What You Should Know

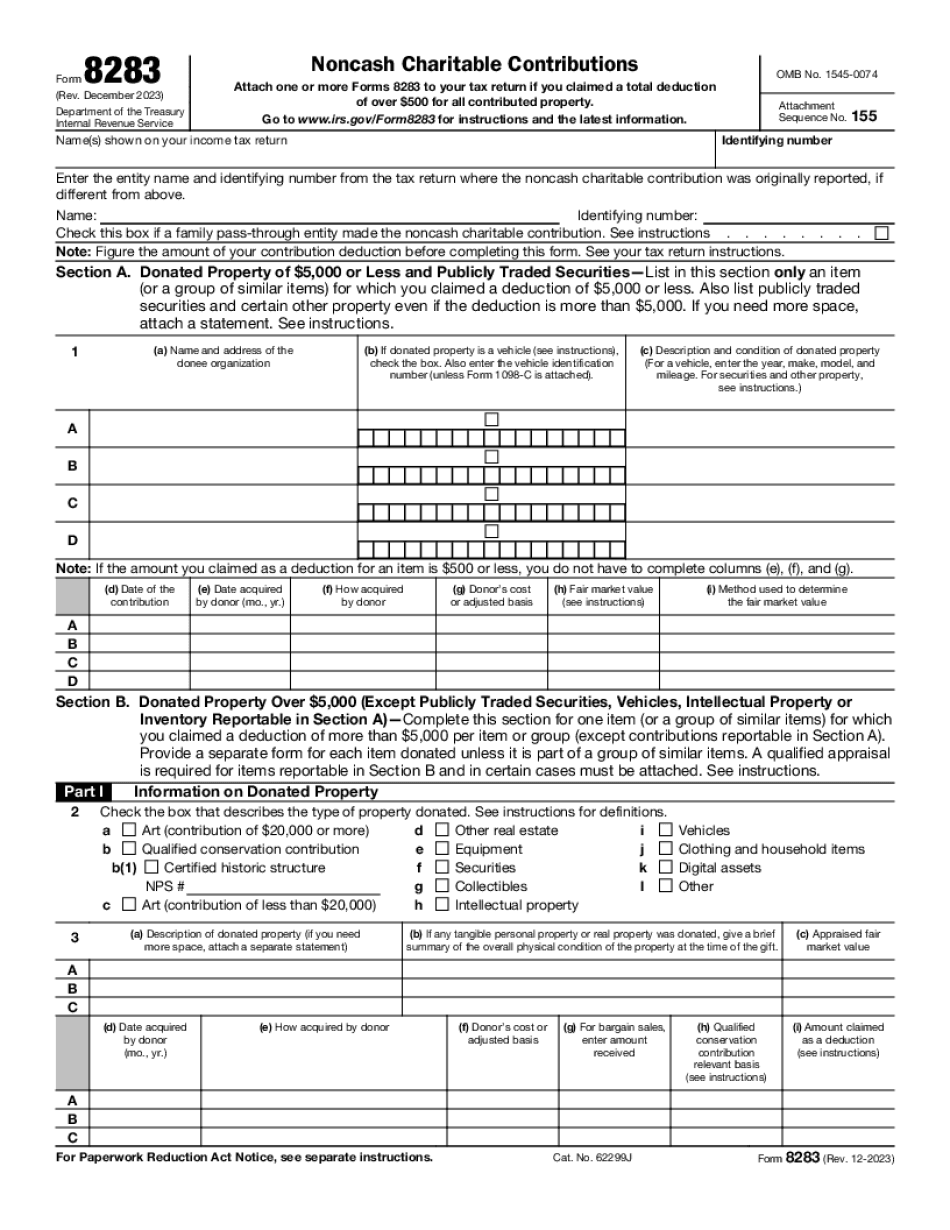

Completely FREE Form 8283 (2018) from IRS — Donate with us! Form 8283, Noncash Charitable Contributions, Form 8283 (Revised), and Form 4562. Filling 8283 – 2025 — Online — Chub Completely FREE form 8283 (2018) form from IRS Fill out & submit fillable form 8 (filed on or before April 30, 2018) form. No need to download PDF. New for 2018, you will have to submit Form 8283 online, not as one single file. Form 8283 (Form 8283-A) and Form 8040; Filing Requirements Filing Deadline for 2019: April 20, 2019, Filer is limited to one charitable contribution from an individual with respect to one or more gifts. Only one item may be a gift. Form 8283 (Amended 2018) Form 8283: 2025 Edition — Donate! Change (Amended 2018) Form 8283 to your particular circumstances. A complete list of all items that can be a gift to the IRS. Filing Requirements for Form 8283 (Amended 2018): You can use Form 8283 (2018 Edition) to claim a tax deduction for charitable contributions if: Item (1)(a) is a “movable property” valued at 5,000 or less. (a) is a “tangible personal property” valued at 5,000 or less. Item (2)(a) is a “group of similar items” valued at 5,000 or less, grouped together under Section (2)(a)-(c), or, when the value is 5,000 or less, valued as a single item. No more than 2,500 of this item may be taxable gross proceeds, with the other 3,500 deductible. The value of the remaining 7,500 must be allocated among the property in accordance with Section (2)(a)-(c). Charitable contributions from a taxpayer other than yourself. Item (3) must be the fair market value of the “realization” of tangible personal property, valued at 5,000 or less within the tax year of the distribution. If no realization was realized, the IRS will determine the fair market value by averaging the comparable sales prices for other tangible personal property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cambridge Massachusetts online Form 8283, keep away from glitches and furnish it inside a timely method:

How to complete a Cambridge Massachusetts online Form 8283?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cambridge Massachusetts online Form 8283 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cambridge Massachusetts online Form 8283 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.