Award-winning PDF software

Form 8283 for Eugene Oregon: What You Should Know

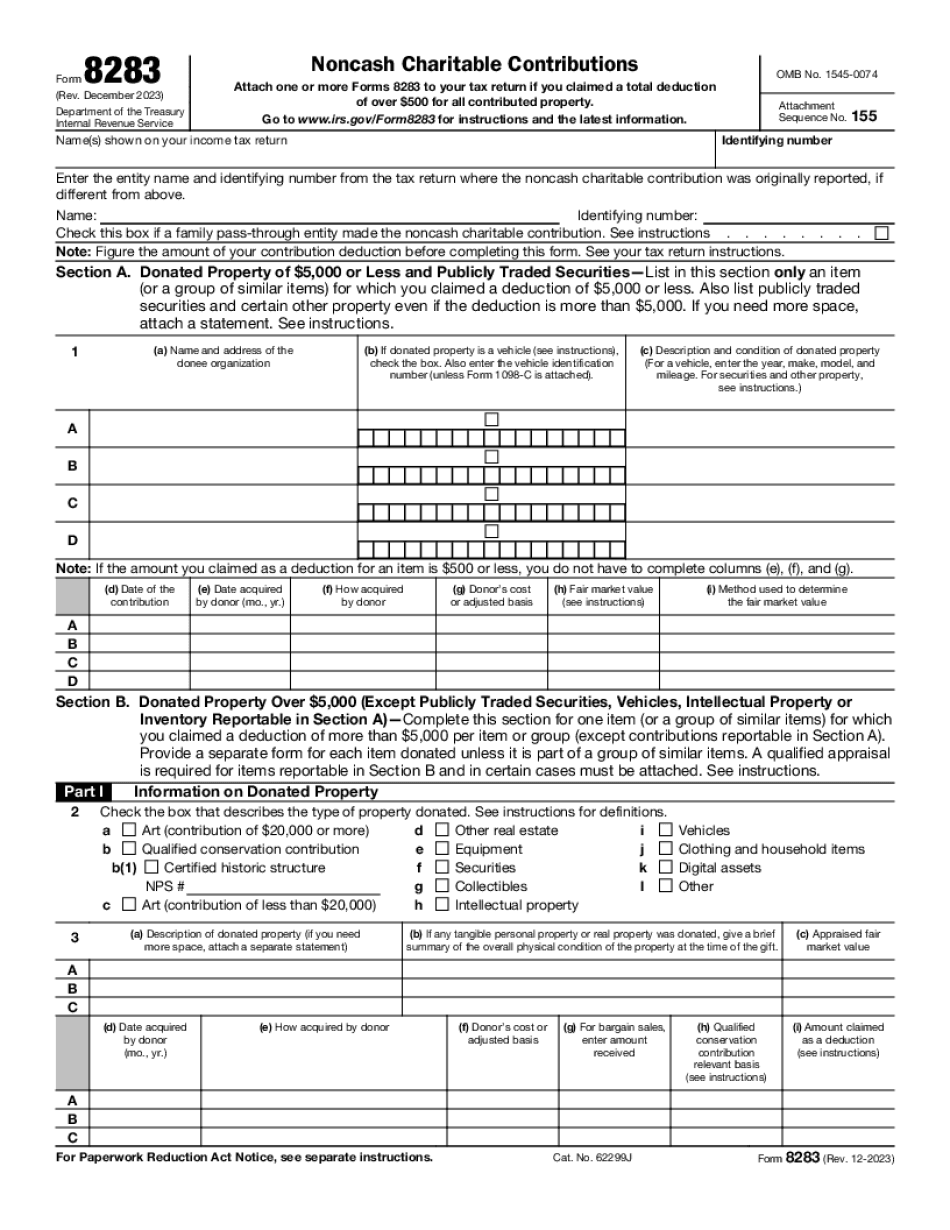

Contributions (Rev. April 2017) In the letter that has been signed by the President and Provost at Lane Community College, the President of UO asked the Board, Board of Trustees, and faculty to sign the form as an assurance that the property was donated to be enjoyed by Lane. To clarify, the President and Provost were expressing their personal belief that the property is, indeed, donated to Lane. To claim a charitable deduction for the donation, donations of property of 5,000 or less, no matter the form and whether the property has been put to other commercial use, must be reported on the IRS Form 8283 and a signed statement will be attached to the form. A donor may deduct the tax from the donor's federal income tax return. Also note that Lane Community College does not receive any property donations from UO. Gifts of Cash or Property — Lane Community College If the value of the gift exceeds 500, the donor need not complete IRS form 8283. Charitable Contributions Reimbursement Form (Paid in Cash) If you have received an official receipt from a public agency that is dated and signed by at least the following of your employees, they must submit to UO the following information in order to claim a charitable deduction for the cash or property which they are reimbursed: Employees who are eligible to claim the deduction must complete their federal income tax returns for the year in which the payment is made or within 12 months after the end of the tax year, whichever is later. Employees who are not entitled to claim the deduction must follow any guidelines required by the public agency. All public agencies must provide that the public agency has determined that your employees are eligible to claim the deduction under the criteria set forth in Internal Revenue Code section 170(c). This determination can be made: At the time the employee receives the payment. By the time they receive the payment or within three months after the date on which the payments are made—if the employee does not request a statement. The employer should retain this information. The request to the IRS for information may be a condition precedent to payment of the check. The amount paid may be subject to taxes. Employees who are ineligible to claim the deduction must follow the procedures set forth in Revenue Procedure 2006-31.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.