Award-winning PDF software

Form 8283 for Surprise Arizona: What You Should Know

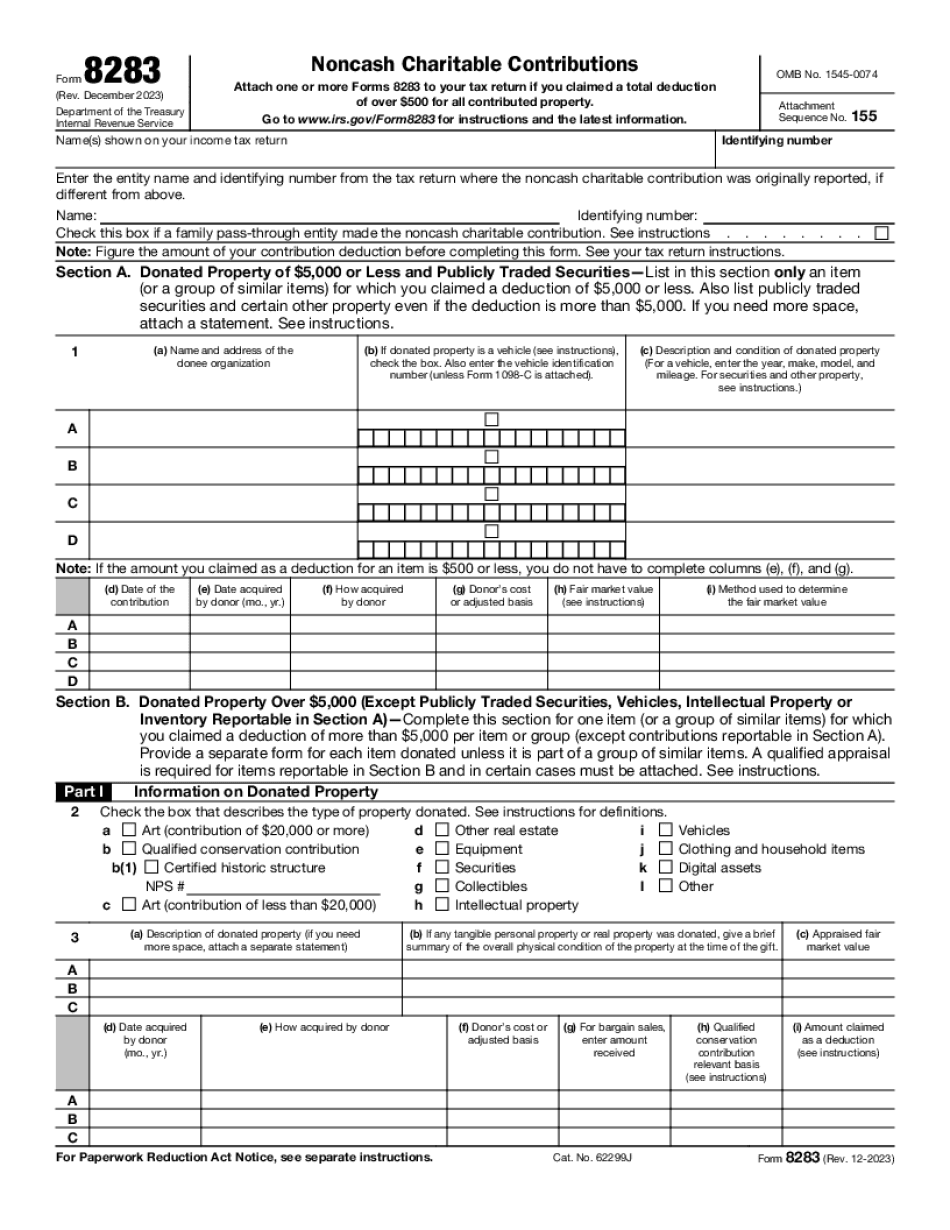

We also included information from form 8283 for months of January 2016, May 2016, and July 2016. We obtained a list of all the conservation easement donors through the state registry of conservation easements. We also took the total value of the easement on each donor's tax return and divided the total of that by the total amount donated. Deduct Certain Charitable Contributions When You Donate Your Property — IRS An individual can take deduction on his, her, or its qualified plan or trust annuity if the individual is a donor of one of the five following types of property (but not other property) for which there are exemptions or a deduction. These properties are any of the following if at least 50 percent of the beneficiaries in any plan are eligible to receive a deduction for their charitable contributions, and they do. Donated property that was: (1) used to provide food, lodging, or medical care to an immediate family member (or a member of a spouse or dependent of a member); (2) used to provide other kinds of food, room, or medical care for someone not a family member; (3) used in trade, profession, or business (or its income is from any such business); or (4) held to provide food, lodging, or medical care for a person with a physical or mental disability or for another person with a physical disability. We provide more information about the requirements in Form 8829, Donating Your Qualified Plan or Trust Annuity — IRS. Example: An employer provides a qualified plan or trust annuity to its employee. The individual receives a qualified plan or trust annuity, as the case may be, if the individual dies and no other qualified plan or trust annuity can be rolled over to the employee. When the annuity is paid out it is not required to be placed in the individual's “vested” or investment accounts. Donation of Conservation Easement — IRS and California Environment Foundation For more information, contact the California Environment Foundation. If you have any questions, call the California Land Trust. Form 8283, Noncash Charitable Contributions — IRS Your Form 8283 should be completed for your city and state. If you live outside the United States, please contact the IRS for its mailing address.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 for Surprise Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 for Surprise Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 for Surprise Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 for Surprise Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.