Award-winning PDF software

Form 8283 for Tallahassee Florida: What You Should Know

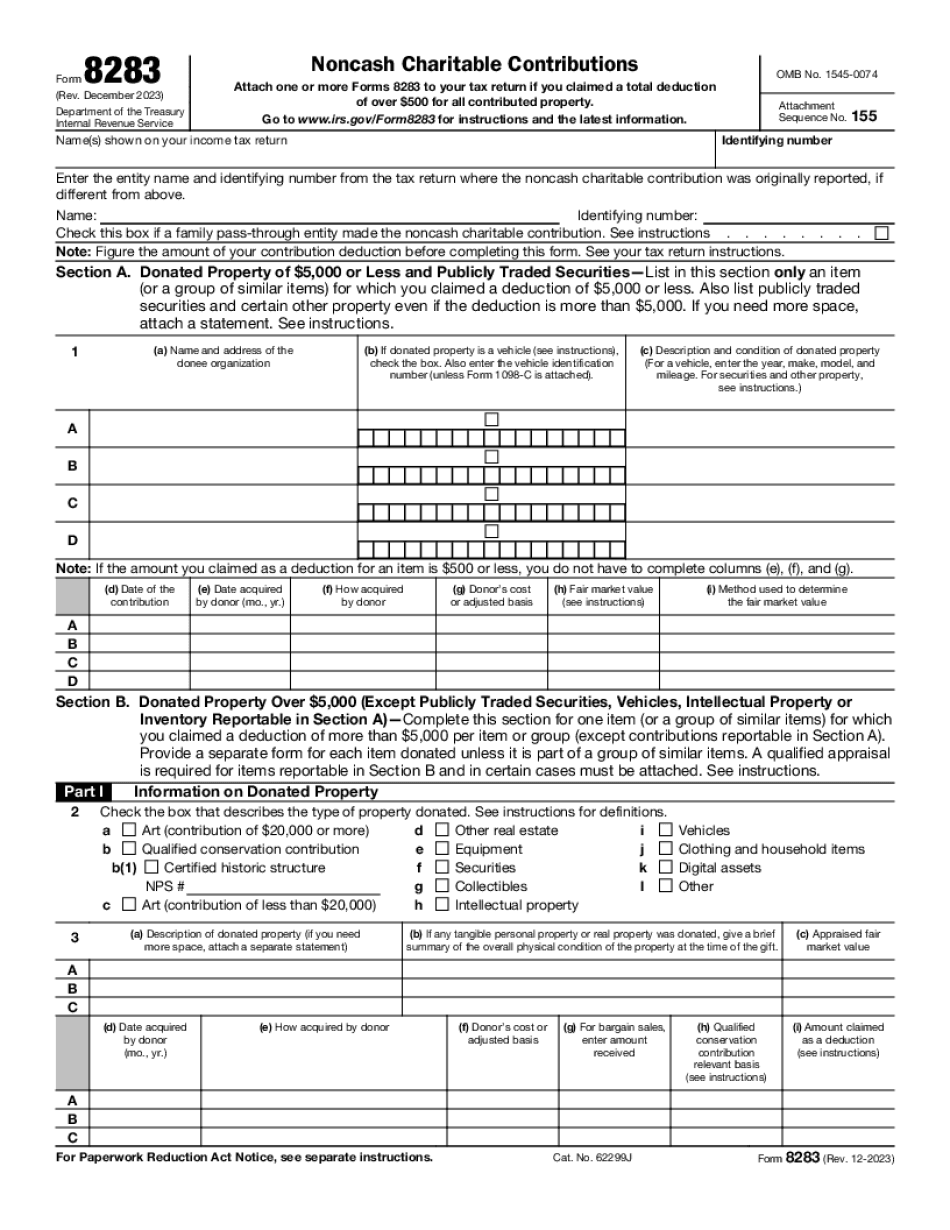

It is the first and easiest step in making a donation to a charity. A charitable donor can also donate goods or services such as office rent, office space. A charitable donor is always required to complete IRS Form 5498. The 5498 form is an IRS statement of tax liability for an item of property donated. It must be filed. Your charity's Internal Revenue Service representative at tax assistance can create a list of the items to be included on IRS Form 8283 (Rev. December 2021.) IRS Form 8283 (Rev. December 2021). Donations made using Form 8283 are not tax-deductible. Tax Relief for Unused Property and Money — Tax Relief for the Unused. Non-taxable donations can be claimed as a charitable deduction Charitable deductions for all donated property are not tax-deductible. Charitable contributions of property worth more than 500 aren't deductible for charitable purposes. The IRS does not allow a charitable donor to deduct any amount in lieu of any other taxes. The charitable deduction for donated property and money isn't allowed to reimburse you for interest on unearned income of which you were required to use the contribution for qualified purposes. Charitable contributions of property from which income was taken aren't deductible for charitable purposes. Charitable contributions of items of property are only available for qualified charitable purposes. You can choose to claim a charitable deduction. Charitable donations of property by you and any person you designate cannot be claimed as a charitable deduction. “Charitable” means “gifts to the public benefit.” Donating “gifts to the public benefit” is not a charitable transaction Donating or bequest of property to a college or university is not a charitable transaction Charitable contributions of unearned income are only available to qualified charitable purposes. You can elect to treat a non-qualified gift or bequest as a qualified gift or bequest of property for purposes of claiming a deduction. You may be able to deduct up to a certain amount of non-eligible charitable gift deductions for your business. A non-income producing property can qualify as donated if the property isn't in existence on the earliest of the date on which the income was earned or the date the property is disposed of. For example, depreciation deductions for business machinery used in the carrying on of a trade or business can be treated as a gift if they were paid or property was transferred to a designated person in exchange and the recipient is the same person giving a tax deduction for the depreciation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 for Tallahassee Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 for Tallahassee Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 for Tallahassee Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 for Tallahassee Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.