Award-winning PDF software

Form 8283 online Bakersfield California: What You Should Know

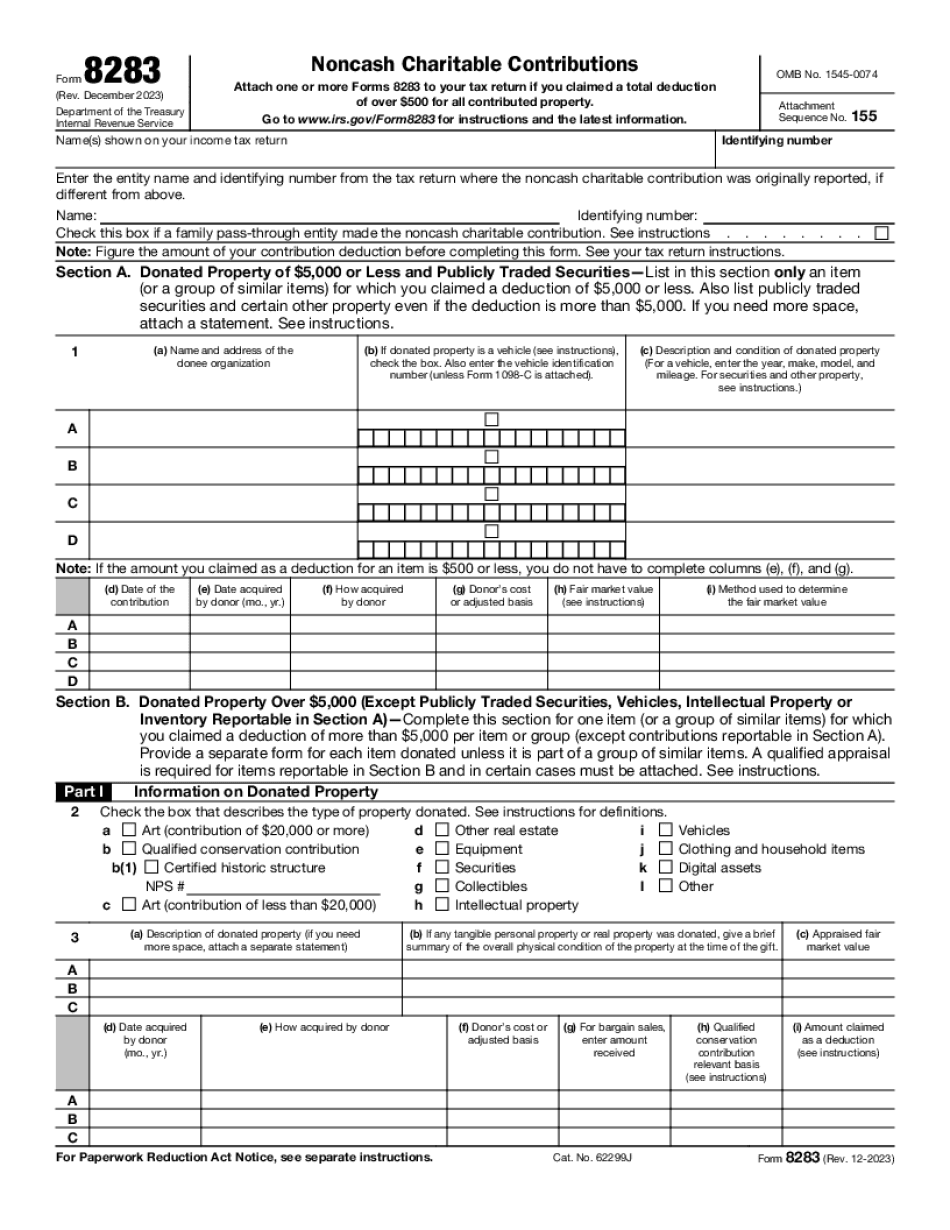

If you meet the noncash guidelines set by the IRS (generally you can reduce or eliminate the noncash limitation by making both a written gift and making a noncash donation), you can claim a tax deduction. Gifts made by means other than written are generally not considered charitable. See What Is Form 8283? For additional information. For those making gifts on their own behalf, the IRS does not require that you sign the Form 8283 before depositing it. The IRS does, however, strongly encourage individuals to register to receive an acknowledgment letter indicating that they have registered for the IRS form 8283. If you don't request an acknowledgment letter, you will not receive it. It is not necessary to sign the Form 8283 if the donation is made by someone other than yourself under the following four circumstances: a gift of an individual other than yourself, a gift made for a spouse, partner, or dependent of yours, a gift made for the benefit of a nonprofit organization that is affiliated with or controlled by you, and a gift made in your own name. When you signed and deposited the Form 8283, you also received a certification that the Form 8283 is “certified in writing,” which means the IRS has reviewed it. It is important to understand that a certified Form 8283 is legal documentation, and you shouldn't assume it represents proof of your charitable giving. The form is a good indication, but not proof, of each time the organization actually received your gift. IRS Form 3220.3 : Gift to a Charitable Organization in Kind Gift in kind (Gift in kind can be used as a payment or reimbursement for property, equipment, services, or any other property or service you provide to a charity not in cash and not for consideration in kind. There is no requirement that a charity accept the gift in kind, but charities that accept the gift are generally considered to be making an accepted charitable contribution. What Are Charitable Contributions? Charitable contributions are contributions, and therefore deductible, to a charitable recipient in kind that are made by you or by your immediate family. Charitable expenses are those expenses that would otherwise be deductible under the income tax laws and may include the expenses described in the following paragraphs (a-b). What Are Charitable Contributions in Kind? If the donation is made in kind, the donor and the recipient have met the requirements, and there is no need for you to sign and file a Form 8283 before depositing.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 online Bakersfield California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 online Bakersfield California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 online Bakersfield California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 online Bakersfield California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.