Award-winning PDF software

Form 8283 online Nashville Tennessee: What You Should Know

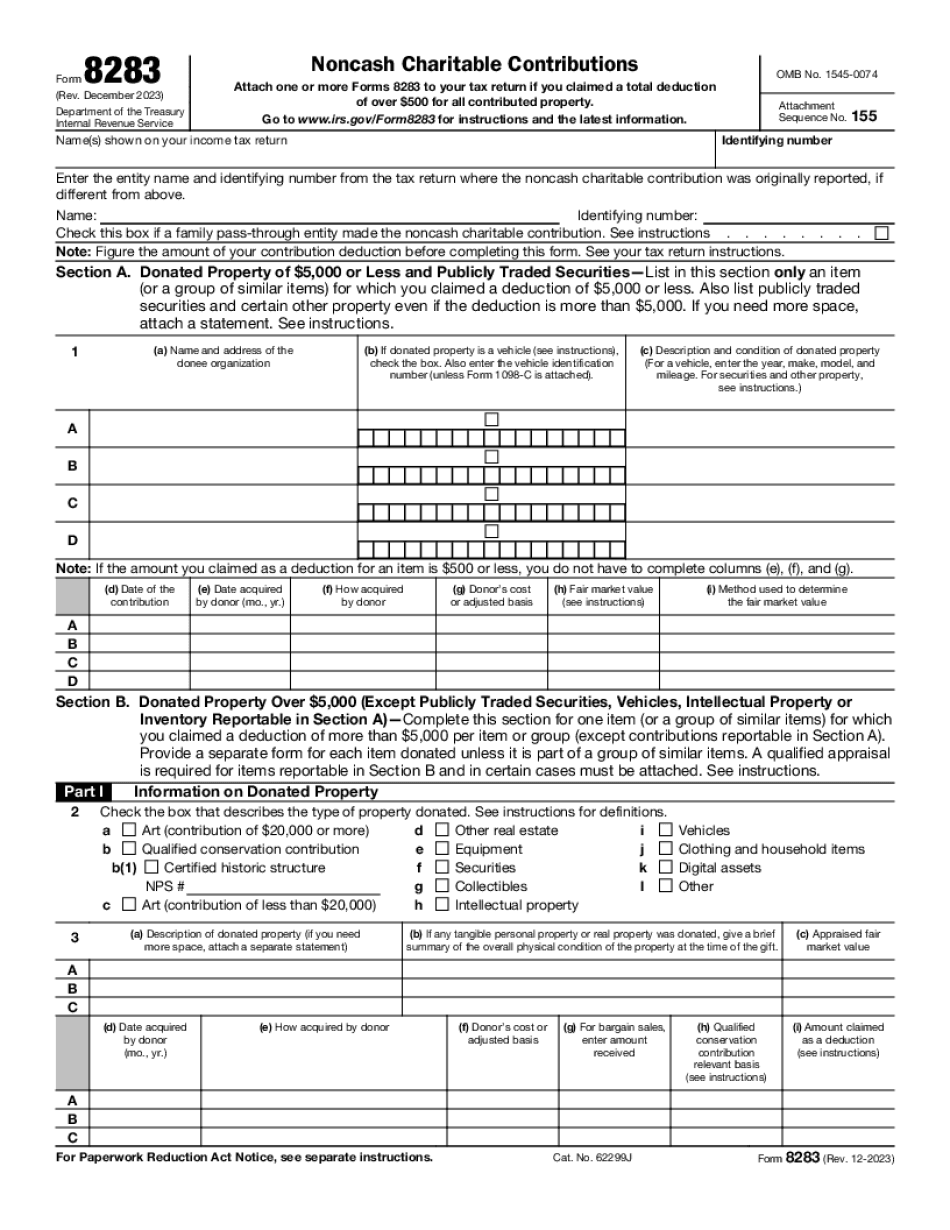

Tax-free contributions to religious, educational, charity, government, and certain other organizations can be deducted when they are includible for federal income tax purposes (i.e., your return and the return of your spouse). Charitable donation contributions are not includible for federal income tax purposes. You can claim the charitable contribution deduction only when the item is an eligible item in a qualified educational institution's tax shelter, described below. For educational institutions, we refer to qualified educational institution as a tax shelter. As an educational institution, the qualified educational institution must have a valid certificate or diploma or a postsecondary degree recognized by the Internal Revenue Service. The tax shelter must be filed with IRS Form 8872, Information Return. If the qualified education institution does not make a statement of qualified education expenses to the IRS, the educational institution can claim the deduction for any amount contributed to a qualified educational institution for tuition, fees, and related expenses. For more information, click the link below: IRS Form 8283 The IRS Form 8283 is a tax-favored return option, which means it is exempt from Form 1040 (and Schedule A) requirements to which other returns are subject. All charitable deductions are limited to those amounts that can generally be deducted. (i.e., there is no 500 deduction limit.) Tax-exempt contributions are not subject to itemized deduction limits. If you are using TurboT ax for tax preparation, the IRS recommends you file the Form 8283 with your return and with your Form 4562. For details, visit TurboT ax page. The IRS Form 8283 is only a tax-favored alternative to the Form 1040 (and Schedule A) to obtain the maximum federal deduction for charitable contributions. For more information, visit IRS Publication 571, Tax Guide for Individuals. You can use TurboT ax to electronically reconcile any discrepancies in your income and distributions reported on your Form 1040 or Form 2553. The IRS publishes the list of all qualified educational institutions at. You can check the list by entering your information and searching by name or type of school. See our page Tax Deductions for Charitable Contributions for details.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 online Nashville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 online Nashville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 online Nashville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 online Nashville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.