Award-winning PDF software

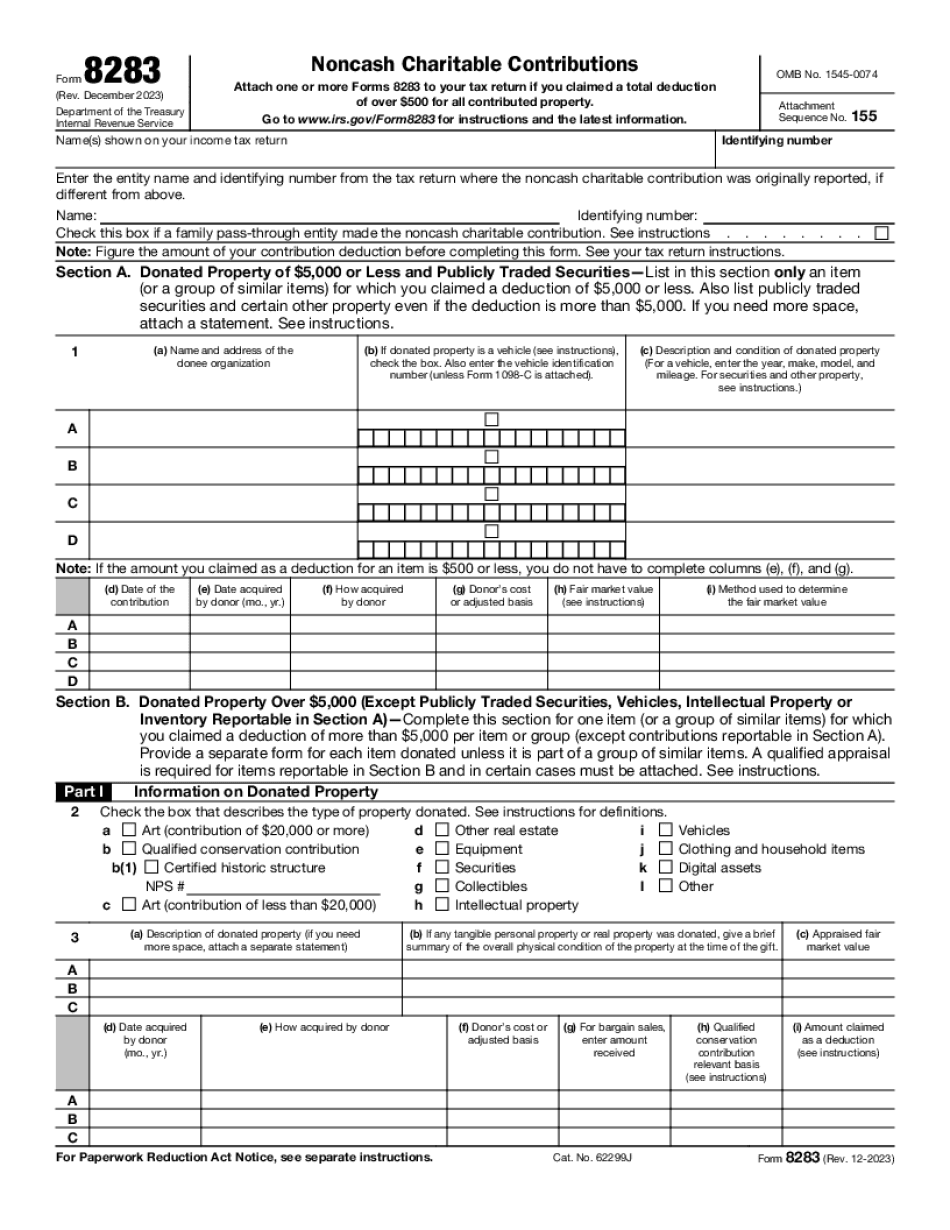

Manchester New Hampshire online Form 8283: What You Should Know

Donations to Your Church — The Church Bureau Learn how to deduct contributions to your church and other organizations with The Church Bureau. Find your church here and learn about how to get in touch with your church. Charitable Contribution Deduction — IRS Learn how you can donate freely to charity with the IRS. Corporate Donations of Property, Parts, and Equipment Your employer can only give you the cash portion of your salary if it was for your own personal use. If you bought your goods and used them for business purposes, you may be able to deduct the items. Elder Business Corporations This article discusses the law on how to deduct charitable donations of a business's corporate income, and the rules for donating property. The law covers most large corporations, but it has been extended to a small business under certain conditions. Learn more about the Law — IRS Donating your time with a religious organization If you give your time to a church, association, community, or society organized for religious purposes, and you meet the requirements, you may be able to deduct the full value of your services, no matter how much you spent. Find the Code Information on Charitable Giving Charitable Organizations and Organizations by State — IRS Information on the law regarding how nonprofits (religious, charitable, fraternal, and other) can be registered. Charitable Contributions Act — IRS Learn about charitable contributions and your tax status with the IRS. How to File Form 5498 For the first time ever, the IRS has released the instructions for Form 5498. There are two versions of the form. The first, known as a Schedule C Form 5498, allows for contributions of up to 2,000 to a qualified organization. The second, known as a Schedule E Form 5498, allows for contributions of up to 100,000 to any one qualifying organization. For the 2025 tax year, if you contribute to any other tax-exempt organization, you will have to use your Schedule E in the 2025 tax year. The IRS does not consider Schedule E Form 5498 to be taxable. Donor Designations of Charitable Contributions Section 170(b)(1)(A) of the Internal Revenue Code permits a person to make a written declaration in connection with a charitable contribution (generally the amount of cash that person receives over a certain value).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Manchester New Hampshire online Form 8283, keep away from glitches and furnish it inside a timely method:

How to complete a Manchester New Hampshire online Form 8283?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Manchester New Hampshire online Form 8283 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Manchester New Hampshire online Form 8283 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.