Award-winning PDF software

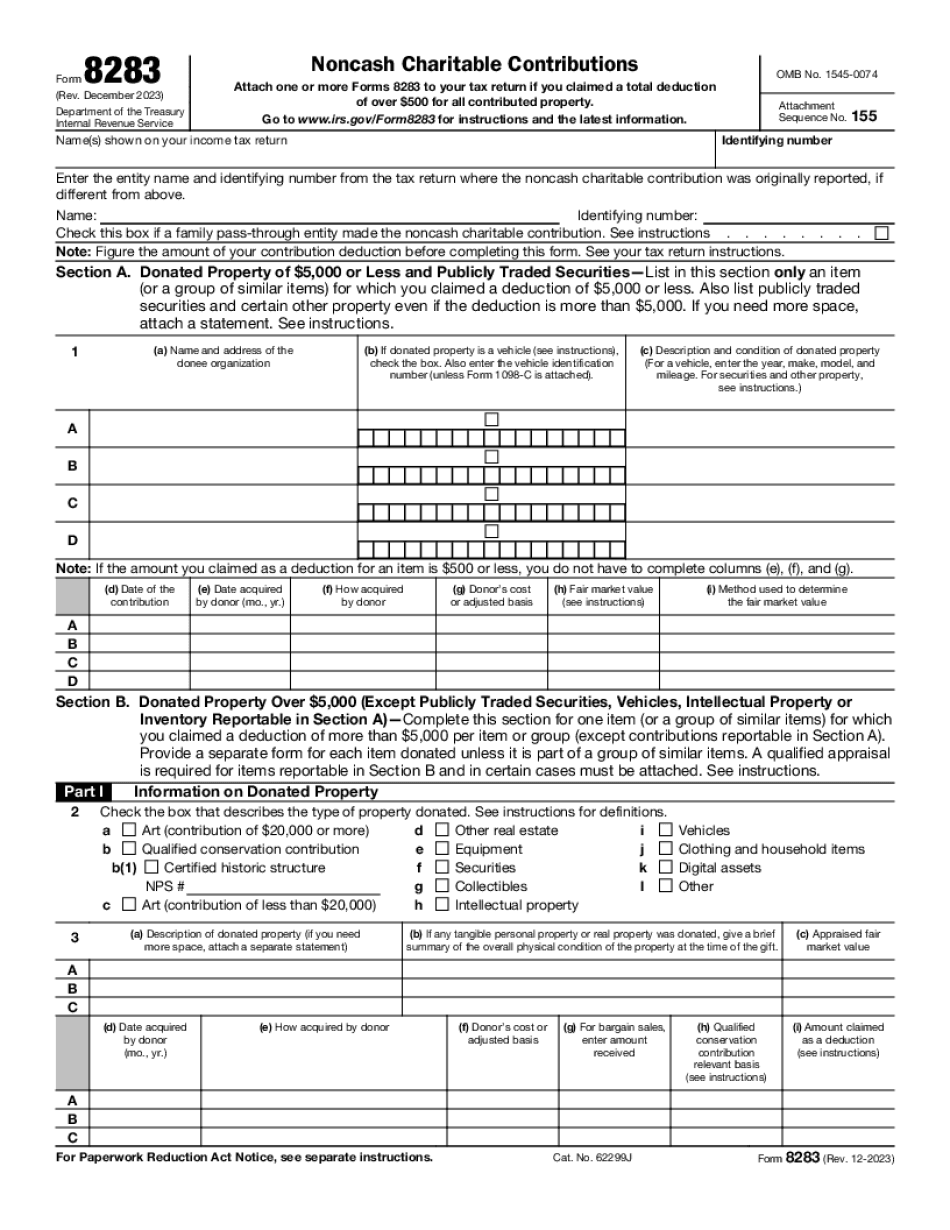

Scottsdale Arizona online Form 8283: What You Should Know

A-F: A-Family, F-Corporation, G-Family, I-Corporation. For most businesses, a single owner with up to 10 employees filing Form 1040, 1040A or Form 1045 generally must file a separate Form 1065, 1066, 1065-EZ, or 1065-N for each of his or her dependents. For larger businesses (50 or more employees), these separate forms may be filed as an integral part of the larger return. To maximize the potential tax benefit of this option, taxpayers should consider preparing and filing separate 1065, 1066, 1065-EZ, or 1065-N for each of his or her dependent family members. If a taxpayer is using an estimated tax return as part of his or her regular annual return and wishes to be granted a tax preference in addition to the standard deduction, then he or she may elect tax credit for a tax year ending in a prior tax year. However, once the election is made, the taxpayer may not change the election. This year taxpayers may elect a tax credit when their return is filed in lieu of filing a separate Form 1065, 1066, 1065-EZ, or 1065-N. If a taxpayer fails to make this election on or before the due date of his or her return, he or she will be subject to a tax on the difference between the adjusted gross income of the individual and his or her adjusted gross income for that year that will be due at the close of the following tax year. For example, if for 2025 a taxpayer has estimated gross income of 75,000, 75,000 is a taxpayer tax on a difference of 15,000, at the close of the 2025 tax year. A taxpayer may also elect credit for more than one dependent as long as all the qualified child tax credits are claimed. Form 8283, Noncash Charitable Contributions — IRS This form must be filed by the due date (including extensions) on which the taxpayer files his or her federal income tax return for the year. To be considered a charitable contribution of property or similar items of property, a property or similar items should not be a personal property (such as furniture or automobiles) unless both of the following are true: It was donated to a charity by its original owner. It was not acquired for the purpose for which it was donated.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Scottsdale Arizona online Form 8283, keep away from glitches and furnish it inside a timely method:

How to complete a Scottsdale Arizona online Form 8283?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Scottsdale Arizona online Form 8283 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Scottsdale Arizona online Form 8283 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.