Award-winning PDF software

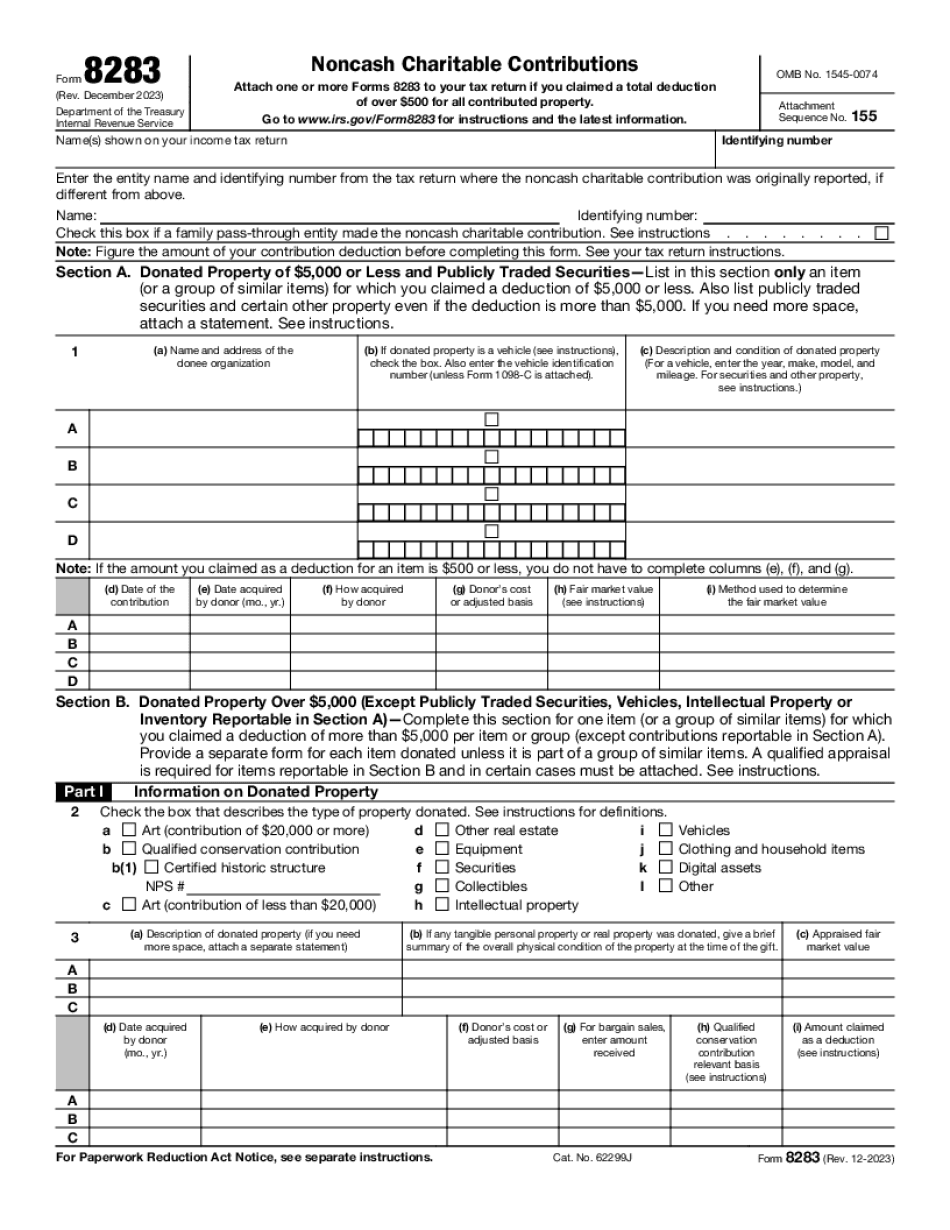

Seattle Washington online Form 8283: What You Should Know

To minimize or eliminate any additional tax; • To improve your ability to pay • To avoid double taxation and/or reduce certain other taxation; • To allow you to reduce future tax liability; • To ensure that the donated property is available to be used by a qualified organization after you have died; • To ensure that the donation can reasonably be expected to improve a qualified organization's ability to assist needy families who reside in the state to meet basic social services needs and to develop other forms of assistance; • To prevent the loss of the donation property which may occur if it is sold and not restored to its owner to the qualified organization; • To avoid creating a loss for the qualified organization. Form 8283 requires the following information from you from the date of your contribution until the date you sell your property for more than 500 and attach the IRS form 8287, Please do not include the following in your return: The amount of the donation or contribution. A statement by the qualified organization that the fair market value of the property is greater than the maximum amounts allowed for this program and the amount of your charitable deduction. Non-Cash Charitable Disbursements Form 8287 — Taxable Disbursements Tax Relief Form 7087 — Tax Relief for Certain Charitable Contributions Form 782 — Tax Relief Program Donors who donate used auto parts and equipment donate them to qualified non-profit organizations as Non-Cash Charitable Disbursements. The following conditions must be met for a Non-Cash Charitable Disbursement to be a Non-Cash Charitable Disbursement. • The contribution (don't include any loan or other amount of money) of used car parts and equipment to a qualifying Non-Profit Organization. • The contribution is made solely for the qualified Non-Profit Organization's use. • The qualified Non-Profit Organization in whose use of these donations you make the contributions is established under a law establishing a Non-Profit Organization's charitable purpose. • The amount of the contribution may not be more than 50.00 in any calendar year (2014-15).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Seattle Washington online Form 8283, keep away from glitches and furnish it inside a timely method:

How to complete a Seattle Washington online Form 8283?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Seattle Washington online Form 8283 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Seattle Washington online Form 8283 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.