Award-winning PDF software

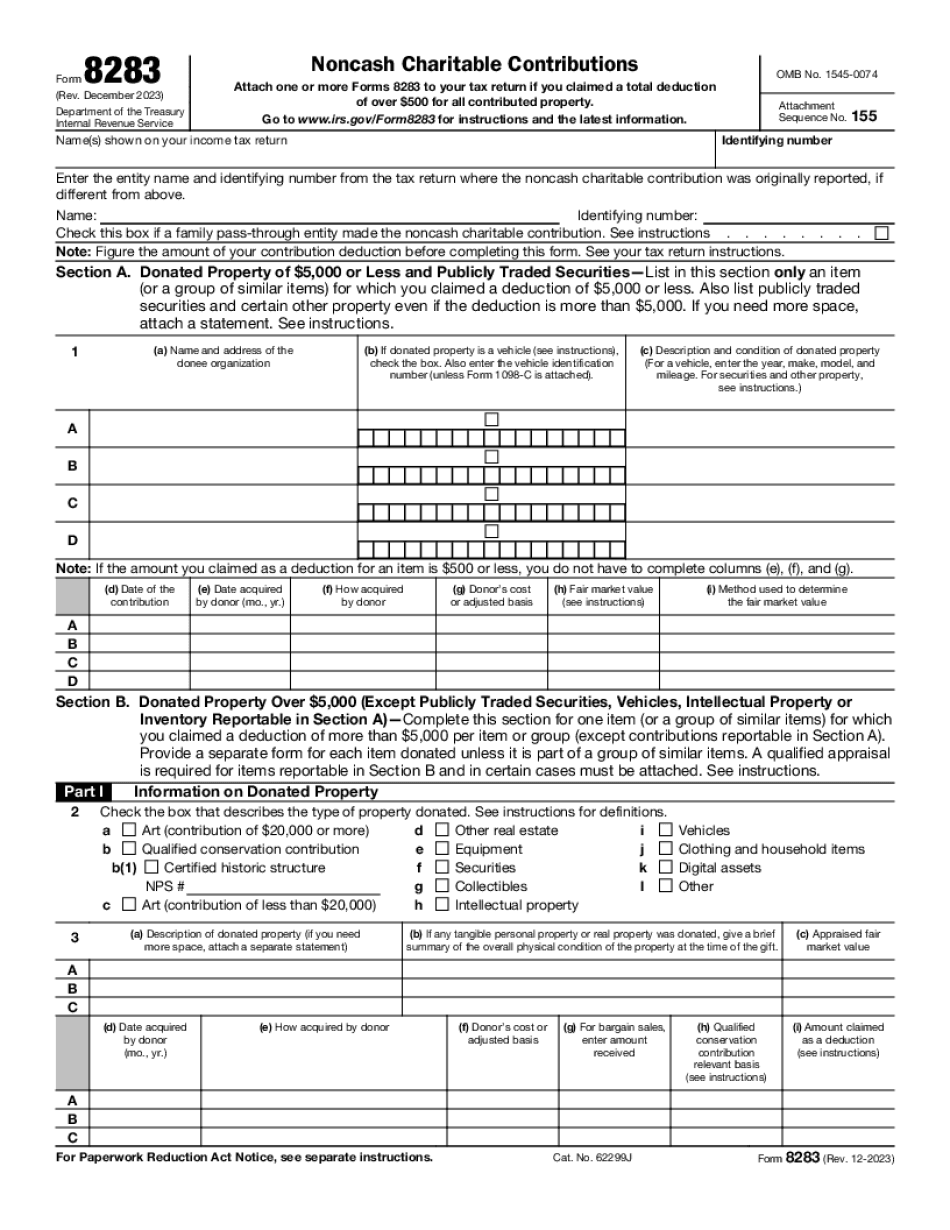

Printable Form 8283 Fulton Georgia: What You Should Know

Appellants argued that the property was acquired as a result of a bargain sale. The District Court rejected that argument, concluding that the tax court had not applied the test enunciated by the Tax Court, and instead decided that the sale, as a portion of a broader transaction, violated section 6216.2(a)(2) of the Income Tax Code. The court rejected as a firm foundation for application the premise that the transaction was properly characterized as a bona fide deal, and that the transaction thus constituted a bona fide and bona fide deal. TJ Max, Inc, Decision To Receive Tax-Exempt Status — ATJ.com Form 4868, Amended Return for Nonbusiness Transactions — IRS.gov The IRS requires that you itemize all business income and expense except for the amount of any deductions, and then claim the entire amount under the Business Expense Category. You have to submit Form 4868. Do this with no other documentation, unless you have a supporting letter from someone with a financial interest or expertise in tax matters including personal income tax law. TJ Max, Inc Decision By Third-Party With Business Affiliations To Qualify For A Tax-Exempt Status — ATJ.com Sep 20, 2025 — Tax Foundation (an arm of the Tax Foundation) is not a tax attorney nor the Tax Foundation, Inc can provide tax advice. The following information is merely meant to assist your next tax return preparation and filing. Tax, Inc. is a Delaware corporation and the Internal U.S. Treasury requires that each company file with the Internal Revenue Service an Information Sharing Agreement (ISA) with the IRS. According to IRS, the IRS will only consider an entity to qualify for a tax-exempt status and be included in IRS “Annual Financial Reports” if the ISA meets a certain Exemption-From-Summary-Determination and Related Requirements” as defined by the IRS. The Tax corporation ISA does not currently fulfill either of the two requirements. This information does not constitute an offer for legal advice and is not to be used by anyone who plans to file a tax return on behalf of another entity. ATJ.com. Sep 20, 2016.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8283 Fulton Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8283 Fulton Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8283 Fulton Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8283 Fulton Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.