Award-winning PDF software

CO online Form 8283: What You Should Know

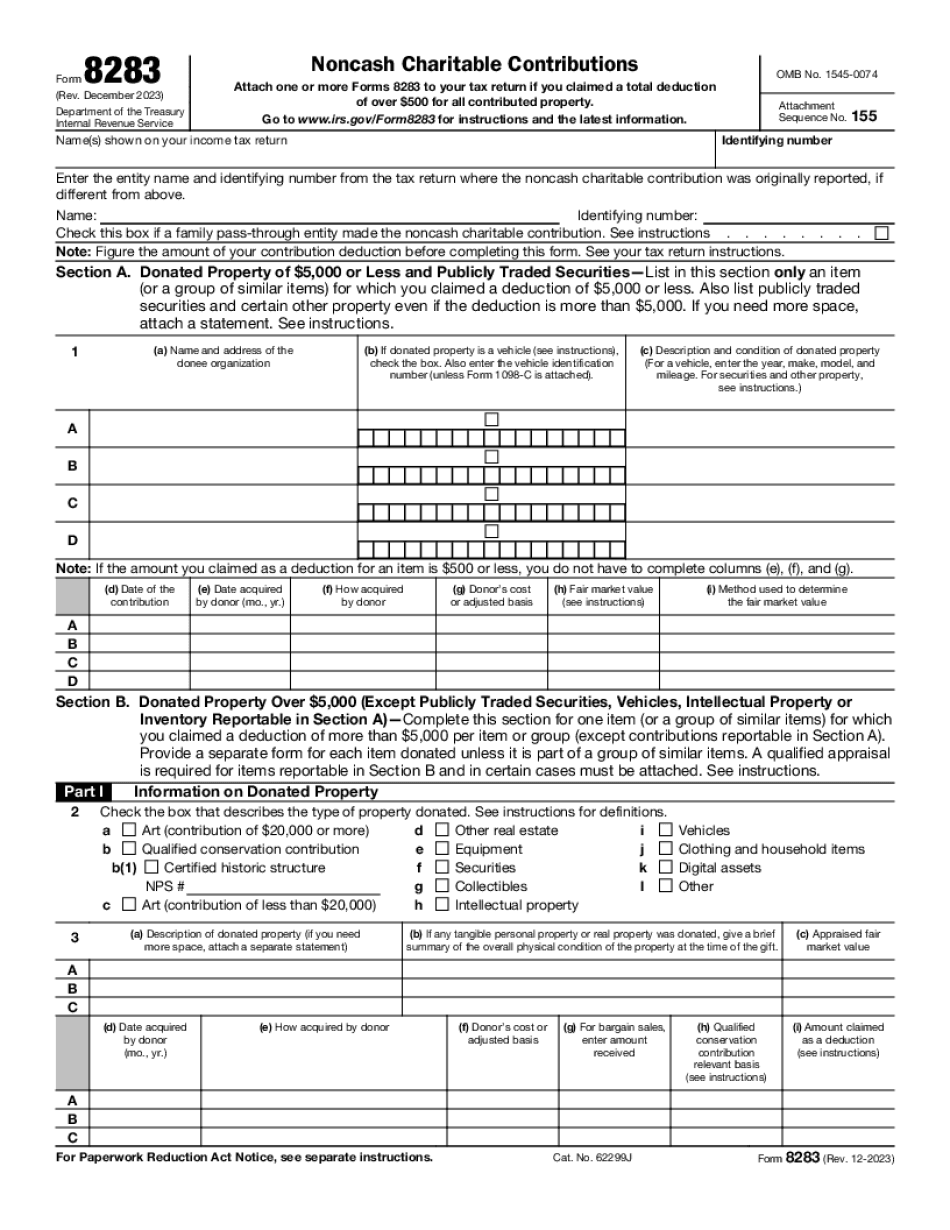

For information on filing and filing fees, see IRS Publication 948. Form 8283 can be used to calculate the charitable or governmental tax deduction that you may receive on certain property or income from certain sources. Generally, the property being donated in excess of 500, minus any property that is subject to income tax in Colorado. It is most commonly used to determine an itemized deduction for non-cash contributions. The itemized deduction is subject to the limitations provided by section 6422, Tax-Free Exemptions for Qualifying Nonprofit Organizations. You must include the full value in your income for tax purposes. To find out more, see the Charitable Contributions Section of Publication 463. Why would I use Form 8283? Use Form 8283 in addition to other income and deductions that apply for qualifying non-cash contributions to any qualified Colorado organization. What is considered to be donated property? The general description of a charitable contribution, without regard to the nature or value of the property to which the contribution relates, may be changed without the seller or donor consent. What are the tax consequences of a donation of non-cash assets? If you are a non-resident and donate non-cash assets to a Colorado qualified organization and the value of your property exceeds 500 (500 minus the amount in excess of 500), you must report the excess in connection with your income and pay Colorado tax on the excess. If the non-cash assets exceed 500, then you may deduct the non-cash amount as a charitable contribution. For information on deducting gifts of property to qualified organizations, see Publication 948. If you live in a different state that has different rules, such as sales tax (for example) on non-cash items, the value of non-cash assets you donate to a qualified Colorado organization may also be subject to income tax in your state. This may cause a difference between the federal and state taxes that you report. When you donate property, such as food, furniture, toys, and household items, you are giving a gift. Donations of property are treated as gifts and are subject only to federal tax rules. Federal regulations say that the value of a gift is determined in the year that the donor gives the property to the charity or to any other person for whom the gift is made.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 8283, keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 8283?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 8283 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 8283 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.