Award-winning PDF software

Form 8283 online LA: What You Should Know

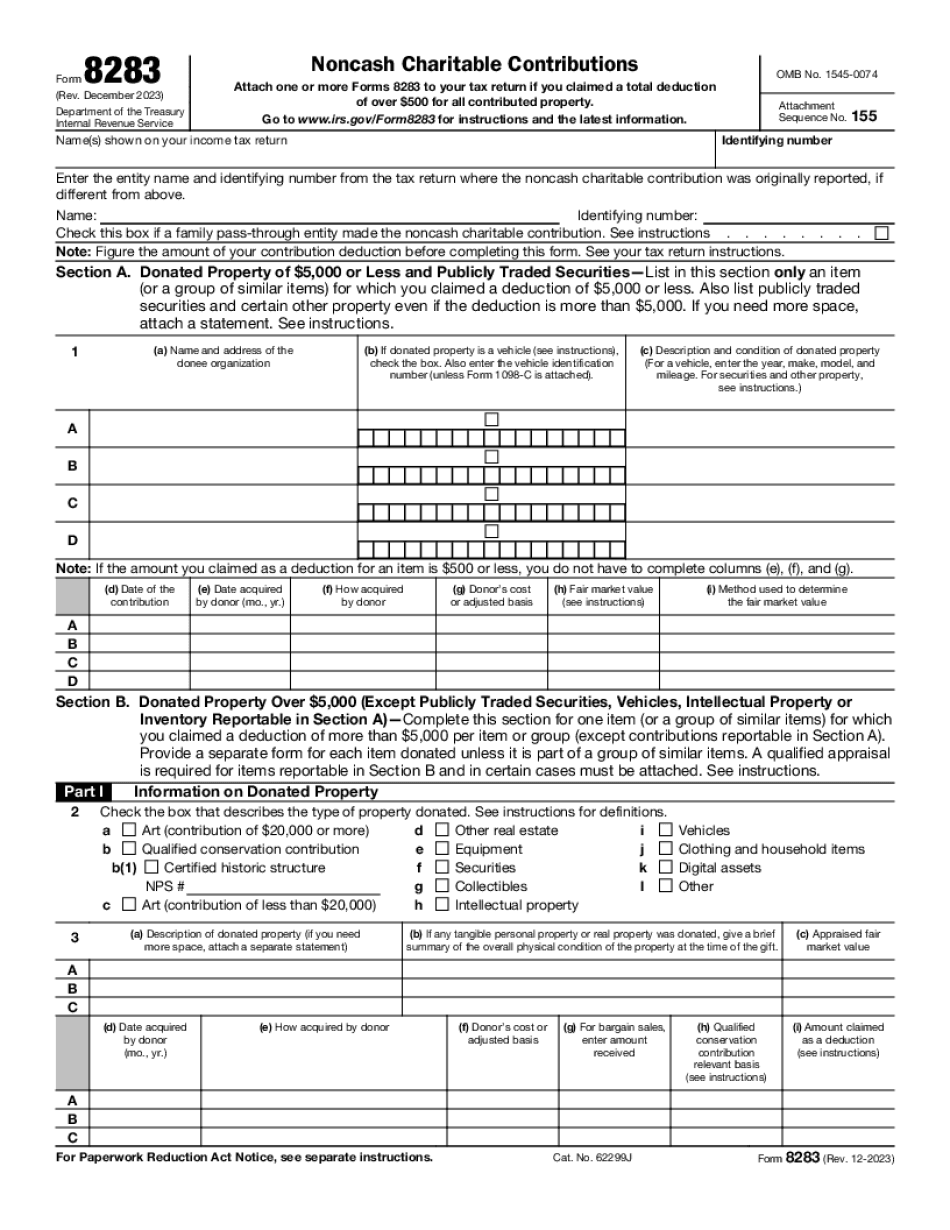

Noncash donations of 500 or less need not be listed on your Form 8283; any donations of 500 or more must be listed. You can find out if you are eligible and use IRS' online search tool to find out if you meet the threshold for donating Property or other items of value. In the tax year from June 15 to June 30, the charitable contributions of 500 or less are a taxable event. To be eligible, donate Property or other items of Value, the value of which exceeds 5,000 in value. If the donated Property is a rental, the value must exceed 500 to be included in the donor's tax return. Property is not limited to cash, real estate and goods and services; it also includes cash dividends, interest, interest-free loans, property acquired by death for a decedent, gifts, or land. The IRS Form 8283 form must be filed electronically by the donor or a designated payee and must be accepted on the taxpayer's return for an item of income or loss. Form 8283 can be filed with the taxpayer's return for the tax year from June 15 to June 30. The tax year starts on the first day of August, which makes the tax return due no later than April 15. Noncash charitable contributions are subject to tax at the donor's regular tax rate. You will receive a refund of any charitable contributions of 5,000 or less claimed under 8283 by filing Form 940. To be tax-exempt, you must: The total value of all gifts of real estate or other property valued at 500 or less that are noncash are also taxable income to the donor of 500 or less. You Can Deduct Donations of Property Or Other Items Of Value of Less Than 500 — FT.ca.gov Section B. Donated Property of 5,000 or Less and Publicly Traded Securities — List in this section only an item. (or a group of similar items) for which you Form 8965, Donated Property of 5,000 or Less And Other Items — IRS Form 8965 (Revised for Tax Year 1999 and later) — IRS Section B. Donated Property Of 5,000 or Less, Donated By the Estate Of A deceased taxpayer — Itemize the item. Itemized deductions are limited to 25% of the value of the property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 online LA, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 online LA?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 online LA aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 online LA from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.