Award-winning PDF software

Form 8283 for Wyoming: What You Should Know

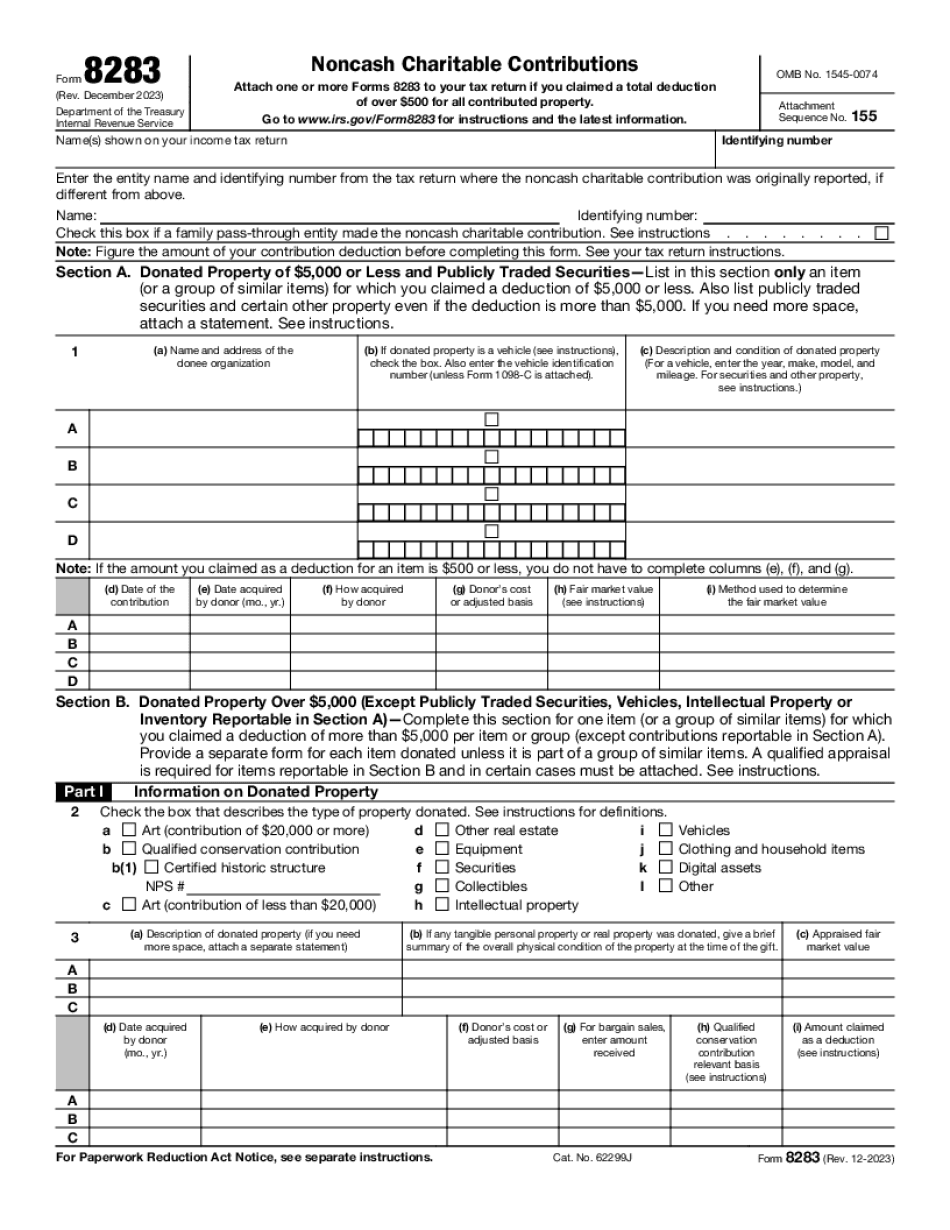

B) In the event the donated vehicle or mobile home is more than ten years old or more than five years old that the donor no longer desires, the donor will be required to file a new Form 8283 to claim a new vehicle value as an improvement on this property. How to Report Gifts To Public and Private Schools with Form 8283 — IRS Form 8283 is used to claim a deduction for a tax-deductible charitable contribution of property or similar items of property, the claimed amount exceeding 5,000. The claim for the deduction for a tax-deductible charitable contribution includes the following items:. . A list of all gifts to be reported to the IRS and the reasons for those gifts. FAQs, Form 8283 — IRS 1. When can my tax year begin? How do I find out? You can start the tax year at the time that you report the gift. 2. If I have over 500 of gifts or annuities (or any item to the value of over 500), can I do the gift and charitable contribution for the 2025 tax year and 2025 and the following 2025 tax years? Not for 2025 unless the value of the item would have exceeded 500 by 2018, and only for the 2025 tax year if the value of those items had exceeded 500 by 2018. However, see the last question. When must I file Form 8283? You must file Form 8283 by the due date (including extensions) for filing Form 1040. If you give a gift, you must file Form 8283 by the due date (including extensions) for the calendar year in which the gift is reported to the IRS, regardless of whether the date of the gift falls on a Saturday, a legal holiday, or on a tax day. This includes a tax holiday! What do you do if you don't file by the due date? The tax year for which you would have claimed the deduction for a gift is the next tax year that your donation took place.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8283 for Wyoming, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8283 for Wyoming?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8283 for Wyoming aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8283 for Wyoming from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.